Accounting and finance are major components of business and form the core of most organizations. The accounting departments monitor bookkeeping systems and present financial statements to management, and interprets them as needed. Bookkeeping is a part of the accounting function and involves the mechanical aspect of recording, classifying, and summarizing transactions in account books and posting them to respective financial statements. Accounting data is crucial to any organization, as it is often used for decision making and control purposes. Accounting and finance are major components of business and form the core of most organizations. The accounting departments monitor bookkeeping systems and present financial statements to management, and interprets them as needed. Bookkeeping is a part of the accounting function and involves the mechanical aspect of recording, classifying, and summarizing transactions in account books and posting them to respective financial statements. Accounting data is crucial to any organization, as it is often used for decision making and control purposes.

Our Accounting training tutorials will introduce you to basic accounting principles and concepts that set the ground for more advanced learning in this topic. You'll be introduced to key accounting terms and concepts

Training Includes Training Includes

Full Multi Media Interactive Lessons

Review Questions to test ones knowledge

Printable Transcripts of lessons

9 Hours of Training

Course Contents

Basic Accounting Principles and Framework

- Key concepts about accounting

- Principles underlying the preparation of financial statements

- Basic accounting practices

- Importance of common accounting practices

- Main characteristics of IFRS

The Accounting Equation and Financial Statements

- How transactions affect the accounting equation

- Common transactions affect specific accounts using the debit and credit rule

- Characteristics of financial statements

- Relationships between financial statements

The Accounting Cycle and Accrual Accounting

- Accounting cycle

- Balance Sheet and Income Statement with Chart of Accounts categories

- Examples of various categories of accounts

- Transactions that are ignored in cash-based accounting systems

- Cash and accrual accounting

Accounting Transactions and Books of Account

- Correct general journal entries

- Using special journals appropriately

- Relationship between journals and associated general and subsidiary ledgers

- Post common transactions from special journals to subsidiary and general ledgers

Trial Balance & Adjusting Entries

- Prepare a trial balance

- Types of trial balances performed within the accounting cycle

- Classify adjusting entries as being accruals or deferrals

- Adjusting entries

- Steps for closing the accounts

The Income Statement

- Characteristics of the Income Statement

- Revenues, gains, expenses, and loss-incurring activities

- Gross profit, operating income, and net income

- How common transactions affect the Income Statement

- Income statement interacts with the other financial statements

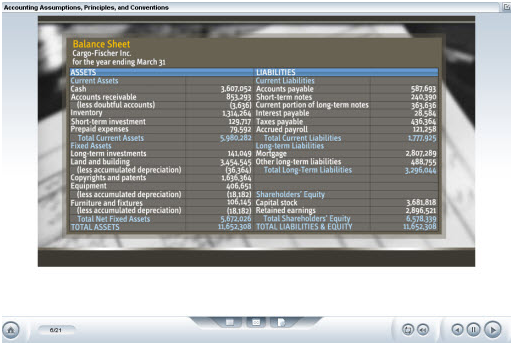

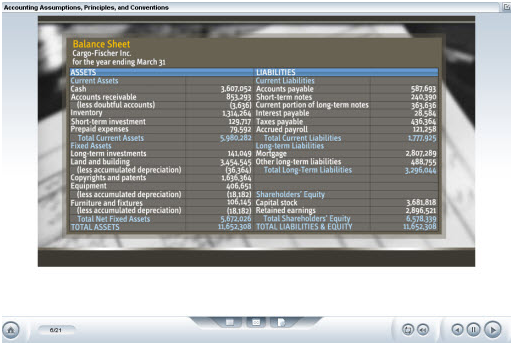

The Balance Sheet

- Components of a Balance Sheet

- Prepare a Balance Sheet

- How common transactions affect the Balance Sheet

- Balance Sheet connects and interacts with the other financial statements

The Cash Flow Statement

- Cash Flow Statement items

- Cash balance at the end of the accounting period

- How the Cash Flow Statement connects with the Income Statement and the Balance Sheet

- Common transactions affect different types of cash flows in the Cash Flow Statement

- Prepare a Cash Flow Statement using the indirect method

Accounting for Companies' Stock Transactions and Dividends

- Incorporated organizations

- Common equity transactions affect a corporation's financial position

- Record the issuance of stock in a journal

- Purchase and sale of treasury stock using the cost method

- Transactions involving cash dividends and stock dividends

|

Accounting and finance are major components of business and form the core of most organizations. The accounting departments monitor bookkeeping systems and present financial statements to management, and interprets them as needed. Bookkeeping is a part of the accounting function and involves the mechanical aspect of recording, classifying, and summarizing transactions in account books and posting them to respective financial statements. Accounting data is crucial to any organization, as it is often used for decision making and control purposes.

Accounting and finance are major components of business and form the core of most organizations. The accounting departments monitor bookkeeping systems and present financial statements to management, and interprets them as needed. Bookkeeping is a part of the accounting function and involves the mechanical aspect of recording, classifying, and summarizing transactions in account books and posting them to respective financial statements. Accounting data is crucial to any organization, as it is often used for decision making and control purposes.